What will happen to the Perth housing market amid interest rate rises?

Article by: Matthew Hughes

Source: The Property Tribune

August 09, 2022

Without a doubt, interest rate hikes have made up its fair share of headlines, over the past few months. Back in May, the Reserve Bank of Australia (RBA) raised the cash rate from a record low of 0.1% to 0.35%. Since then, it has increased to 1.85%. The rate rise came despite RBA Governor Philip Lowe’s adamance that rates would not rise until 2024, a position he has held as recently as last year.

The rate hike was driven by the steep rise in inflation, which is at its highest level since the GST was introduced in 2000; of course, all eyes were on the central bank when inflation was revealed to be 5.1%, in April. The steep rate rises have been considered, by many, as extraordinary.

November 2020 was the last time cash rate changed at all, and the last time interest rates increased was a decade earlier, in November 2010.

Record-low interest rates are just that: record low. They are and should have not been expected to remain as such. Lenders’ rules have tightened towards serviceability, with APRA advising a 3% stress test above the loan product rate. Previously, this was 2.5%.

While capital cities across the eastern seaboard have felt the pinch, Perth property is not expected to follow suit.

Before the rate rises, many households in Sydney and Melbourne were spending about 40% of their disposable income on mortgage repayments, according to the Real Estate Institute of Australia. Perth households, however, were only spending around 26%. Both of these stats are likely to have increased given the rate rises.

Unlike the eastern capitals, Perth has only recently equalled its previous median price record, set back in 2014.

But what does this mean for the Perth property market?

Perth has traditionally been counter-cyclical to the east coast markets, including when interest rates have risen.

Consider two pivotal moments in recent history: The 911 attacks, and the Global Financial Crisis (GFC).

Global uncertainty was abounding following the September 11 attack on the Twin Towers. In December 2001, the Reserve Bank cut the cash rate to a then-relatively low level of 4.25%. As the Australian economy picked up, performing better than expected, the rate began increasing from May 2002, eventually peaking in early 2009, just before the Global Financial Crisis hit. Across these periods of global turmoil, property prices rose significantly.

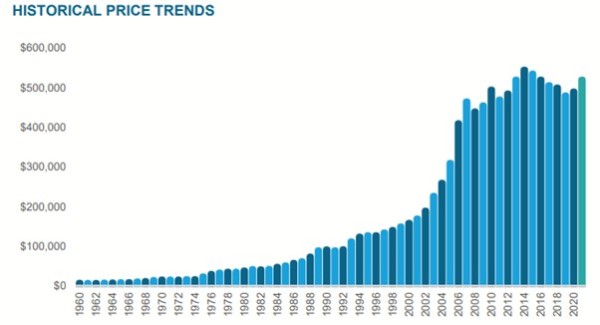

The median house price in Perth grew sharply year on year until 2008, according to REIWA.

Source – REIWA

Forward to today, supply is continuing to tighten. The vacancy rate is currently 1.2%. This is set to worsen due to ongoing labour shortages and supply chain constraints, making it unlikely a significant rise in housing stock will occur any time soon. Further compounding the matter, WA’s population is expected to grow to 3.1 million by early 2030. Housing stock will need to be boosted significantly between now and then to service demand.

All of this considered, I expect Perth to continue its recovery despite the recent rate increases, and subsequently, expect moderate growth over the next two to three years.

Currently, Perth is the capital city that our research is driving our clients to for optimal investment outcomes. Keep an eye out for our upcoming report on Victoria, and the opportunities we feel this market will present from early to mid-2025. CPA Property Reports are the ultimate research tool for those considering an investment into the any Australian property market.