Perth property leads nation, set for double-digit growth this year

Article by: Martin Kelly, Property Reporter

Source: Australian Financial Review

February 24, 2021

After years in the doldrums, Perth’s property market has emerged as the nation’s strongest with two separate reports pegging the West Australian capital as the national market leader in price growth.

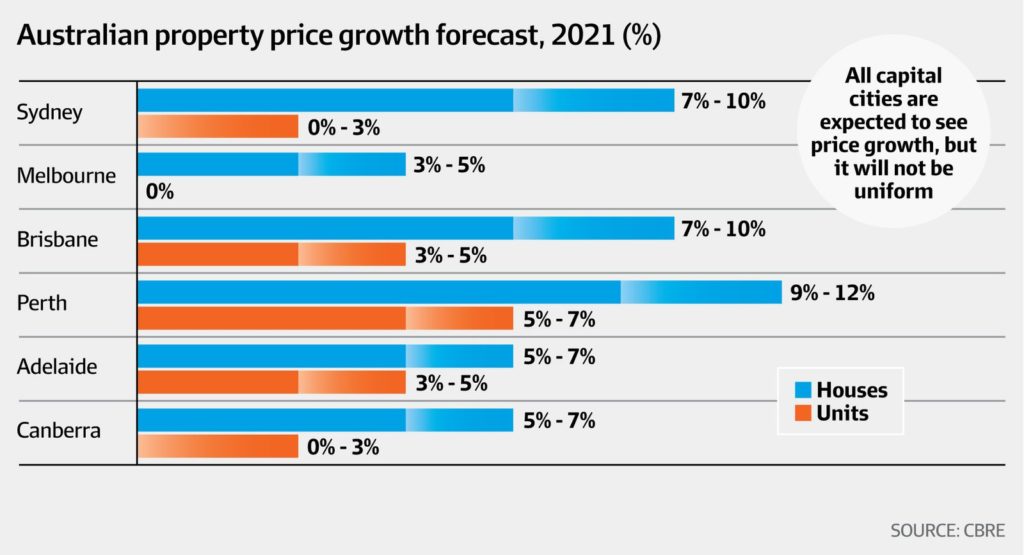

In its Australia Real Estate Market Outlook Report, released yesterday, CBRE predicted Perth houses this year would increase in value by between 9 per cent and 12 per cent, and unit prices would rise 5 to 7 per cent.

CBRE said Brisbane and Sydney house prices also would outperform, growing 7 to 10 per cent.

More moderate but still impressive growth is anticipated in Adelaide and Canberra, where house prices are forecast to increase 5 to 7 per cent.

Melbourne is expected to have a more subdued recovery, with house prices up 3 to 5 per cent.

House price rises will far outstrip those of units in all markets.

Strong economic performance in Western Australia is the main driver of rising house prices in Perth, said Craig Godber, CBRE’s head of residential research.

“A return to positive interstate migration, accompanied by a solid resources sector outlook, is helping propel Perth’s housing recovery ahead of the nation,” he said.

“Federal government incentives such as HomeBuilder and additional state support packages are boosting the construction sector and further contributing to growing confidence in the market.”

Perth’s rental market also was running hot, he said.

“Supply remains tight, with vacancy rates already under 1 per cent, leading to strong rental growth and providing opportunities for investment in 2021.”

Meanwhile, Perth was Australia’s top-performing prime property market last year, ahead of Brisbane and the Gold Coast, according to The Wealth Report 2021, published by global property consultancy Knight Frank.

Perth ranked 34 in Knight Frank’s Prime International Residential Index (PIRI) of the top 100 markets.

Knight Frank said Perth recorded 3.6 per cent growth in its prime property market, defined as the top 5 per cent by value, giving it a global ranking of 36. Prime property prices in Brisbane and the Gold Coast also did well.

“Australia’s luxury residential market fared well, with three of the five cities included in the PIRI 100 recording growth greater than the global average, and in the case of Perth nearly doubling it,” said Michelle Ciesielski, head of residential research Australia at Knight Frank.

“Grounded by travel bans, Australia’s luxury buyers focused on building their property portfolios at home, buoyed in part by the country’s bullish stock market and historically low interest rates.

“While Perth was Australia’s frontrunner for luxury residential price growth over 2020, Sydney recorded its highest ever volume of prime sales in the third quarter of last year and preliminary data is indicating the fourth quarter surpassed this.”

Currently, Perth is the capital city that our research is driving our clients to for optimal investment outcomes. Keep an eye out for our upcoming report on Victoria, and the opportunities we feel this market will present from early to mid-2025. CPA Property Reports are the ultimate research tool for those considering an investment into the any Australian property market.